Seven months ago, KyberSwap deployed on the Avalanche network for the first phase of a collaboration that saw great success in improved liquidity and rates for Avalanche’s decentralized finance (DeFi) ecosystem, allowing Kyber Network to kickstart collaborations with popular ecosystem projects.

The long-awaited phase two of Avalanche liquidity mining is ready to launch.

Starting from March 21, at 1:00 pm UTC, liquidity providers can add liquidity to eligible pools on KyberSwap on Avalanche and access approximately $1 million in Avalanche (AVAX) and Kyber Network (KNC) liquidity-mining rewards for the next four months.

What is Avalanche?

Avalanche is an open, programmable smart contracts platform with high throughput and near-instant transaction finality. The platform’s high performance has helped it become a popular, rapidly growing venue for DeFi decentralized apps (DApps) and nonfungible tokens. KyberSwap will continue playing a vital role in providing critical liquidity infrastructure for Avalanche’s thriving DeFi ecosystem.

“Enhancing liquidity opportunities is a key factor in growing the DeFi ecosystem and welcoming new participants into the community. We support Kyber’s vision to deliver a sustainable liquidity infrastructure and welcome their protocol to establish a more valuable ecosystem on Avalanche,” said Emin Gün Sirer, director of the Avalanche Foundation.

Why use KyberSwap?

Liquidity providers on KyberSwap enjoy important benefits not available on typical automated market makers.

- Decentralized exchange (DEX) aggregation — Better rates are available on BNB Smart Chain (BSC) versus trading on individual DEXs by a dynamic trade routing feature that aggregates liquidity from multiple DEXs, including the capital-efficient KyberSwap pools.

- Amplified liquidity pools — Liquidity providers use amplified pools that enjoy excellent capital efficiency with reduced trade slippage. With the same pool and trade size, stable token pairs with low price-range variability — e.g., Tether (USDT) and USD Coin (USDC) — can have up to 400-times better slippage than other platforms. Liquidity providers can provide better prices and earn more fees with less capital.

- Dynamic fees — Protocol fees are adjusted dynamically based on market conditions to maximize returns and reduce the impact of impermanent loss for liquidity providers, with fees automatically accruing from pool transactions.

- Fully permissionless — Anyone can create a pool or add liquidity to existing pools, while any DApp, DEX aggregator or end-user can access this liquidity. KyberSwap is already integrated with 1Inch Network, ParaSwap, 0x, Matcha and Slingshot, with more aggregators and DApps later.

- Reliable and secure — KyberSwap’s codebase has been audited by external auditors such as ChainSecurity and is open-source on GitHub for community review. KyberSwap doesn’t use third-party oracles and is not vulnerable to external oracle risks. It is also covered up to $20 million by decentralized insurance provider Unslashed Finance.

Rainmaker on Avalanche:

KNC and AVAX worth approximately $5.8 million have been allocated as incentives for the Rainmaker and Avalanche liquidity mining program.

Initial plans were to allocate approximately $1 million to the first phase and the rest to the second phase. However, after deep discussion between the teams and community feedback, the Avalanche Rush program is allocating another approximate $1 million to phase two and the rest to phase three.

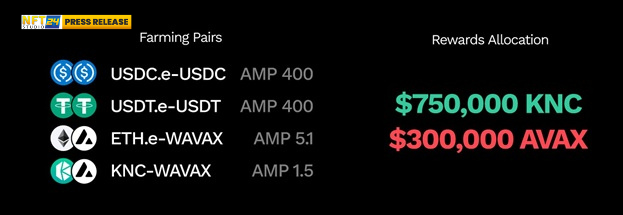

Phase two will distribute $1 million in AVAX and KNC incentives to four pools.

Important details

- Start: March 21, at 1:00 pm UTC

- Duration: four months

- Rewards: Approximately $300,000 in AVAX and $750,000 in KNC incentives

The following pools and token-vesting opportunities are available. It should be noted that the “e” after a cryptocurrency ticker means that crypto is running on the Avalanche Bridge (AB) announced last year — e.g., USDC.e.

- Pools: USDC.e and USDT; Ether (ETH.e) and Wrapped Avalanche (WAVAX); KNC and WAVAX

- Token-vesting: USDC.e and USDT for 60 days; USDT.e and USDT for 60 days; no vesting for ETH.e and WAVAX or KNC and WAVAX.

The KNC token contract with Avalanche is here.

Participate on Rainmaker by bridging assets to Avalanche. Ethereum assets can be easily migrated by the Avalanche Bridge, a cross-chain bridging technology that transfers assets between blockchains. Use the Avalanche Bridge to transfer ERC-20-protocol assets to the Avalanche cross-chain mainnet MetaMask wallet.

After bridging assets, assets will be displayed with the “e” symbol — e.g., USDT.e — and users must add custom token addresses to display them in the Metamask wallet. See all addresses for supported assets on the proof-of-assets page.

How to farm AVAX and KNC

- First, have AVAX in possession on the Avalanche network for gas transaction fees.

- Visit KyberSwap.

- Visit the Pools page and add liquidity to eligible Rainmaker pools identifiable by a raindrop icon. After added liquidity, provider tokens will be received to represent users’ pool shares after.

- Go to the Farm page and click “Approve” on the farm to receive liquidity. Once approved, stake liquidity provider tokens on the farm and start receiving AVAX and KNC rewards that can be harvested.

- Harvest rewards at any time. A 14-day vesting period starts with rewards unlocked at every block when harvested. There is no vesting period for BenQI (QI) rewards.

- Go to the Vesting tab to claim rewards once unlocked. Claim all unlocked KNC rewards after 14 to 60 days. Vesting starts each time rewards are harvested. Unlocked rewards can be claimed anytime.

- To remove liquidity, users must first unstake any liquidity provider tokens on the Farm page, then visit the My Pools page to view and remove their liquidity positions. For more details, visit the guide on how to remove liquidity.

Watch the tutorial video for detailed instructions on yield farming. The example video is on the Ethereum network, but the steps are similar to Avalanche.

Learn more about Avalanche:

1: Website 2: Developers 3: Twitter 4: Telegram 5: Discord

About Kyber Network

Kyber Network is building a world where any token is usable anywhere. KyberSwap, its flagship DEX, provides the best rates for traders in DeFi and maximizes returns for liquidity providers.

KyberSwap powers more than 100 integrated projects and has facilitated more than $7 billion of transactions for thousands of users since inception. It is currently deployed on nine chains, including Ethereum, BSC, Polygon, Avalanche, Fantom, Cronos, Arbitrum, Velas, Aurora.

1: KyberSwap 2: Discord 3: Website 4: Twitter 5: Forum 6: Blog

7: Reddit 8: Facebook 9: Developer portal 10: GitHub 12: KyberSwap documents