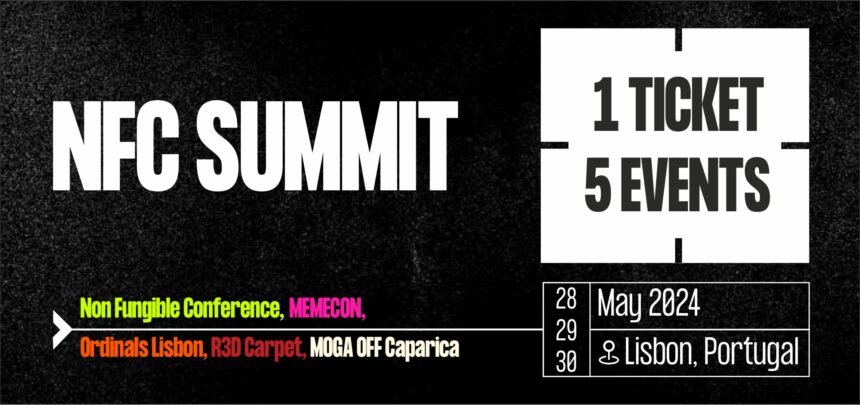

Featured Interview

Featured Interview

Bitcoin, Ethereum & Crypto News

Cryptocurrency Price Prediction

Expert's Voice

Read More

Been reading about biotech and considering to use crypto to accelerate research funding in biotech.

Read More

Consumer utility in web3 is happening - you can feel it.

Read More

As Bitcoin nears its all-time high, investor sentiment is mixed, with some taking profits while many hold on.

Read More

I wish there was modular, open source software that could be used to coordinate resources, align incentives, and enable real time settlement

Read More

Wins and losses will come. If I survive, I can leap forward with the next victory.

Read More

If history repeats Next Bull Market peak may occur Sept-Oct 2025.

Read More

Self-custody is important. And social recovery and multisig is a great way to do it.

Read More

Bitcoin’s market cap is higher right now than it has ever been in history.

Read More

Every year in crypto is like 10, makes sense.

Read More

You earn $ by utilising the business opportunities you come across.

Previous

Next

- Advertisement -