Bitcoin halving 2024 was the much-anticipated event, which has come and gone like a wind. The event has surely marked the historic moment in the world of digital assets. In this article we will mainly discuss:

- Bitcoin Halving 2024

- Pre and Post Halving Events

- Post-halving Bitcoin Demand and Supply

- Post-halving Bitcoin Price Prediction of upcoming 5 years

Overview Of Bitcoin

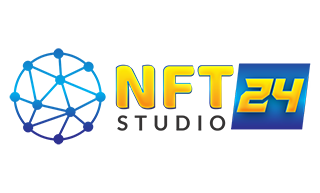

On April 19, 2024, as the Bitcoin halving finally happened, the block reward for bitcoin miners reduced by half, from 6.25 BTC per mined block to 3.125 BTC per mined block. According to Coin Metrics, the price of bitcoin has been volatile ahead of the event, and during the same week, it fell about 4% to trade around $64,100.

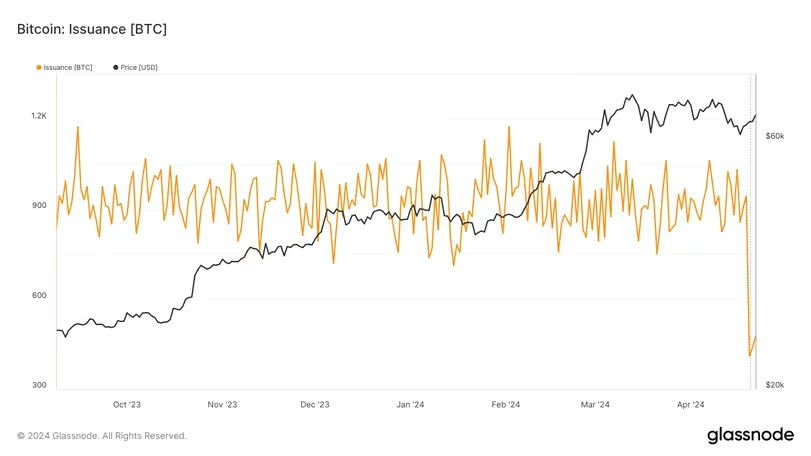

Glassnode has also shared a report where he shared the issuance of BTC per block during all four halvings. Find the chart below for your reference.

Before we move forward and discuss pre and post Bitcoin halving factors, let’s quickly give you a recap of the last three rounds.

Bitcoin Halving History : 2012, 2016, and 2020

It is evident from history that Bitcoin halving events are posed as significant milestones in the cryptocurrency market. Why? Because there is a direct relationship between the rate at which new bitcoins are created and the total supply of bitcoins in circulation.

Let’s examine Bitcoin’s price behavior before and after each halving event.

2012 Halving

The first Bitcoin halving occurred after the network had verified 210,000 blocks. The rewards for Miners had cut in half from 50 to 25 bitcoins per block. At the time of halving, the price of Bitcoin was $12.20 in the market. After the halving, experts observed a bull run pattern, where Bitcoin prices surged to $1,000 by the end of 2013.

2016 Halving

The second Bitcoin halving event occurred in 2016 with a total of 420,000 blocks reached. This led to a further reduction in the mining reward, dropping from 25 to 12.5 per block. Experts had some uncertainties about Bitcoin prices before the halving. Bitcoin was trading at $650.3 during the event and finally held on to grip in May 2017, eventually reaching a peak of around $19,188 by December 2017.

2020 Halving

The third halving event occurred with a total of 630,000 blocks. Following the previous halvings’ pattern, the mining rewards were halved from 12.5 to 6.25 per block. Bitcoin’s trading started at $8,821.42 before quickly rising to $10,943 in April 2021. The coin reached its highest value ever at $69,000 in November 2021.

Bitcoin’s Rise And Fall Since 3rd January, 2024 To Pre-Halving

Bitcoin, the world’s largest cryptocurrency has been constantly navigating between rise and fall during the past decade especially since 2021. On 3rd January, 2024 bitcoin took a big leap of breaking all previous records by reaching 73,1351.0 (I:BTPD). The market for Bitcoin opened at $44,961.60 and closed at $42,847.18, making it the largest recovery since 2023.

March 5, 2024: Price Fluctuation Due To Large Selling Orders

The crypto market took crazy turns on 5th March, 2024. Bitcoin took its all time high and then quickly tumbled down. According to Yahoo Finance, the market opened for Bitcoin at $68,341.05 and took a high shot at $69,170.63. During the same day, it faced a sudden headlong fall to $59,323.91 and closed the market at $63,801.20. Apparently, the large sell orders at Binance exchange capped the rise in price beyond $69,170.63, and led to the sudden fall of Bitcoin.

Now, how did industry experts take this situation? Well, following the fluctuation in value, industry experts suggested holding asset movement until some stability or at least until April.

Ed Tolson, CEO and founder of the Crypto Hedge Fund Kbit said in an interview to CNN, “The market is positioned for a steep correction, possibly between 10% and 20%.” He further added, “Any material move down will result in cascading liquidations on the crypto perpetual swap markets, where retail has piled into levered long positions, where funding rates are very high. Over the next few quarters, we expect bitcoin to perform well, but with sharp corrections along the way.”

Nevertheless, the groundbreaking rise of Bitcoin value fueled after the U.S. securities regulator approved the first U.S listed exchange traded funds (ETFs) to track bitcoin.

Bitcoin ETFs: Post – Approval Impact In Bitcoin Market

Ever since the US Security Exchange Commission approved the ETFs, the market hopped on a ride that has no brakes. The year 2024 started with an all time high Bitcoin price, shortly after, Spot ETFs approval became the highlight. Moving forward, the supply and demand factors played pivotal roles in recent events unfolding around Bitcoin.

Spot Bitcoin ETF Growth Since SEC Approval

The U.S. Securities and Exchange Commission (SEC) approved the first-ever batch of spot bitcoin exchange-traded funds (ETFs) on January 11, 2024. The agency gave green signal to Spot bitcoin ETFs after undergoing a chaotic and confusing approval process.

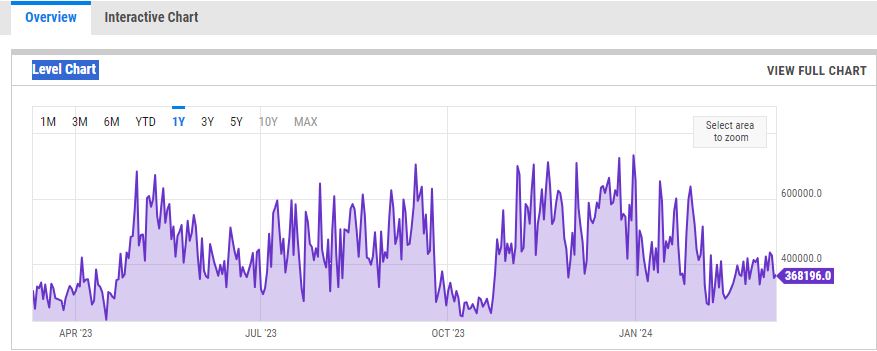

The first 11 approved spot bitcoin ETFs came from Bitwise, Grayscale, Hashdex, BlackRock, Valkyrie, BZX, Invesco, VanEck, WisdomTree, Fidelity and Franklin.

Beginning Of Spot ETFs

Trading for spot bitcoin ETFs first began on January 11, 2024. At starting they reached $4.6 billion in volume within the first day of trading, with BlackRock’s product alone hitting $1 billion. After the first seven days of trading, the products saw $20 billion of trading volume.

One month post approval, the spot bitcoin ETFs accrued billions of assets under management (AUM). By the end of January 2024, BlackRock’s IBIT had gained $2.7 billion of assets while Fidelity’s FBTC had gained $2.3 billion. To show you the current scenario, please see the chart below shared by The Block Data.

The approval was a huge step for the cryptocurrencies ecosystem. It did not only enable investors to hold tokens directly but also to trade on regulated exchanges via existing financial instruments. But what is the post-halving scenario of Bitcoin and Bitcoin ETFs? Keep reading to know more about it!

Post Bitcoin Halving 2024 Impacts

According to a projection presented by Bitfinex, Bitcoin’s (BTC) recent mining reward halving has changed the market in such a way that it could potentially lead to cryptocurrency’s demand being five times greater than its supply.

As Bitfinex presented, one day after halving, the per-block reward paid to miners was cut in half to 3.125 BTC from 6.25 BTC. The crypto exchange further says, when the rewards are halved, it suggests the total value of new coins added to the supply each day could drop to $30 million. That’s a big decrease, about five times less than what people usually want to buy in U.S. spot ETFs every day.

Analyst of Bitfinex said in one of the reports, “With the daily issuance rate declining post-halving, we estimate that the new supply added to the market (new BTC mined) would amount to approximately $40-$50 million in USD-notional terms based on issuance trends. It is expected that this could possibly drop over time to $30 million per day, including active and dormant supply as well as miner selling, especially as smaller miner operations are forced to shut down shop.”

“The average daily net inflows from spot Bitcoin ETFs dwarf that number at over $150 million, even though flows have moderated and even turned net negative over recent weeks.” analysts added.

The significant drop in Bitcoin supply has been seen in the market. The number of supply has dropped to 450 BTC, which is nearly $30 M from the pre-halving four-year average of around 900 BTC, as reported by Glassnode.

Since Jan 11, a dozen spot-based ETFs began trading in the U.S, allowing investors to own cryptocurrency without owning the entity. Bitfinex is assuming that the average daily inflows into ETFs since inception will remain constant in the coming months.

Post- Halving Bitcoin Value

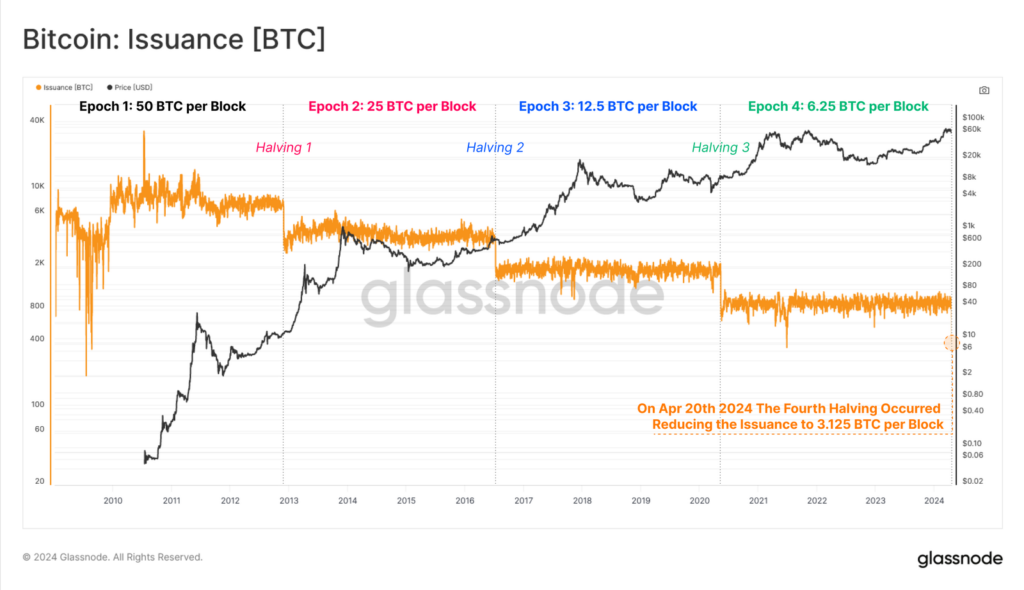

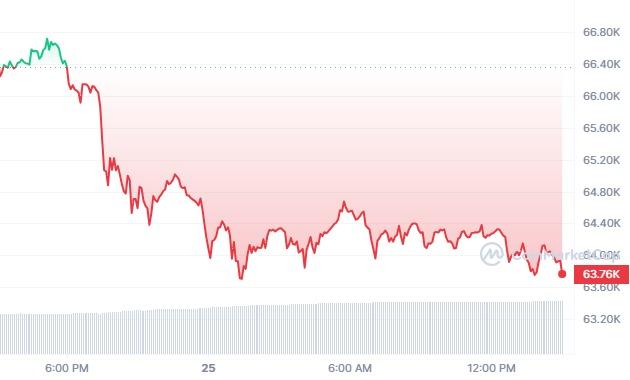

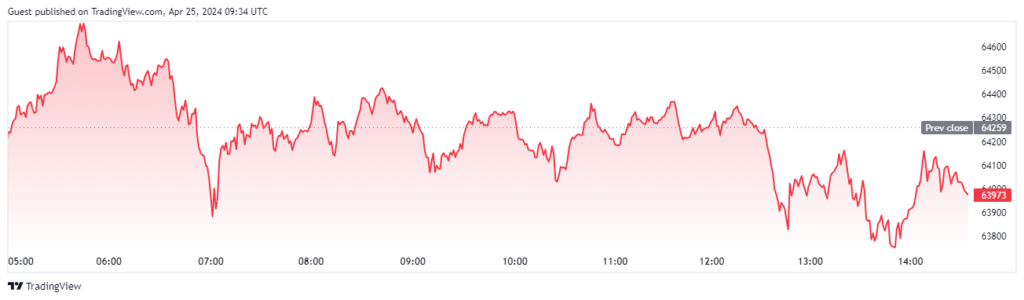

Currently, the Bitcoin value is at USD USD $63,882.13 with an decrease of 3.78% in the past 24 hours. In 2022, as per CNN, Bitcoin’s value dropped by 60% in 2022 , which made investors quite skeptical about its credibility. However, post-halving Bitcoin’s price performance has changed the market, leading to positive impact as of now.

Bitcoin Price Prediction: 2024 – 2030

During March, after soaring to $73,000, Bitcoin declined and remained stagnant between $65,000 and $69,000. Precedently, Bitcoin prices moved up and down a month before halving events. So was the case this time.

In retrospect, Bitcoin halving didn’t directly impact on its prices for until a year. However, this time market situation apparently seems different as compared to previous halvings due to ETF turmoil in January. Now, the halving event is over, let’s see how experts have predicted Bitcoin prices for the upcoming 5 years.

Bitcoin Price Prediction 2024

The approval of Bitcoin Spot ETFs has sent the price of Bitcoin soaring, with five consecutive months of bullish run. Now, Bitcoin is ready to face the challenge of reaching the $50,000 mark.

Additionally, Tether has purchased 8,888 Bitcoin (BTC) for $380 million, further boosting confidence in the cryptocurrency.

2024 is expected to be a bullish year for Bitcoin, especially with the history of halving years leading to significant price increases. Moreover, we can hope for interest rate cuts in the US market, which will fuel Bitcoin’s upward trend.

Analysts predict that Bitcoin could reach above $100,000 and may not drop below $35,000 in 2024.

BTC price trends over the past year sourced by BTC USD — Bitcoin Price and Chart — TradingView

Bitcoin Price Prediction From 2025 – 2030

| Year | Lowest Price ($) | Highest Price ($) | Average Price ($) |

| 2025 | 61,357 | 140,449 | 95,903 |

| 2026 | 82,522 | 155,284 | 115,569 |

| 2027 | 152,837 | 169,047 | 160,942 |

| 2028 | 174,063 | 192,908 | 183,485 |

| 2029 | 204,634 | 239,559 | 222,096 |

| 2030 | 277,751 | 347,783 | 312,767 |

Conclusion

With Bitcoin halving coming to an end, experts have already started predicting the next halving of 2028. Precedently, the Bitcoin halving 2024 is slowly moving towards a Bullish trend. We may expect that the halving will have a long-term positive effect on the Bitcoin price. If we take a recap on previous three rounds of halving, especially of halving 2016, we can predict a follow-up by an upward movement in the price of the cryptocurrency.

Additionally, the broad acceptance of Bitcoin exchange-traded funds (ETFs) has become fuel in five times higher demand of Bitcoin than its supply. Spot Bitcoin ETFs will also play a vital role in shaping market volatility due to their ability to attract large inflows and can impact outflows. A combination of limited supply from the halving and high ETF demand could lead to higher price of BTC.