Ever since the US Security Exchange Commission approved the ETFs, the market seems to be on a ride that has no brakes. The year 2024 started with an all time high Bitcoin price, shortly after, Spot ETFs approval became the highlight. Moving forward, the supply and demand factors played pivotal roles in recent events unfolding around Bitcoin. Nonetheless, Bitcoin ETFs are prevalent in the market and several predictions are coming to the highlights.

What Is a Bitcoin ETF?

A bitcoin exchange-traded fund (ETF) is an investment fund that allows investors to gain exposure to the price movements of bitcoin without actually holding the asset itself. Shares of a bitcoin ETF are traded on traditional stock exchanges, which makes it easier for investors to participate in the cryptocurrency market. Institutional and retail investors, both are showing interest since ETFs approval as they offer a more convenient and traditional way of investing in Bitcoin.

If you are wondering how a Bitcoin ETF works, it is just simple! The price of one share trading on exchange fluctuates as per Bitcoin’s value. Bitcoin and the ETF have a direct relationship. If Bitcoin value increases, so does the ETF, and vice versa. Though the ETF trades on market exchange instead of trading on a cryptocurrency exchange.

Spot Bitcoin ETF Growth Since SEC Approval

The U.S. Securities and Exchange Commission (SEC) approved the first-ever batch of spot bitcoin exchange-traded funds (ETFs) on January 11, 2024. The agency gave green signal to Spot bitcoin ETFs after undergoing a chaotic and confusing approval process.

The first 11 approved spot bitcoin ETFs came from Bitwise, Grayscale, Hashdex, BlackRock, Valkyrie, BZX, Invesco, VanEck, WisdomTree, Fidelity and Franklin.

Trading for spot bitcoin ETFs first began on January 11, 2024. At starting they reached $4.6 billion in volume within the first day of trading, with BlackRock’s product alone hitting $1 billion. After the first seven days of trading, the products saw $20 billion of trading volume.

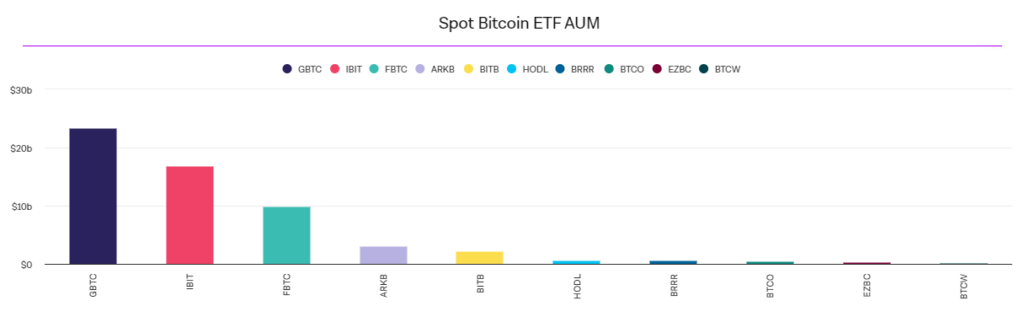

One month post approval, the spot bitcoin ETFs accrued billions of assets under management (AUM). By the end of January 2024, BlackRock’s IBIT had gained $2.7 billion of assets while Fidelity’s FBTC had gained $2.3 billion. To show you the current scenario, please see the chart below shared by The Block Data.

The approval was a huge step for the cryptocurrencies ecosystem. It did not only enable investors to hold tokens directly but also to trade on regulated exchanges via existing financial instruments. But where does this lead to? How does it affect markets and investors? Let’s take you through everything you need to know about the Bitcoin ETF and its milestones.

Cathie Wood’s Prediction On Bitcoin Price

On 8 March, Friday, Cathie Wood appeared on ‘Markets With Madison’ to talk about roaring trends of Bitcoin in the market. ARK Invest CEO, Cathie Wood says Bitcoin will reach $1 million by 2030. How? In the past week the price of Bitcoin reached $68,000 (US). Currently, the supply-demand dynamics and halving of Bitcoin are most likely to take it beyond anticipation.

Cathie Wood, is the founder of ARK Investment Management LLC. ARK is the third largest U.S Bitcoin ETF, which has US$2b of inflow since it launched in January. She acknowledges the impact of the US launching its first spot Bitcoin exchange-traded funds (ETFs). She pointed out the remarkable shift in the market and how spot ETFs are increasing investor’s interest.

However, in the interview she suggests that Bitcoin’s production will halve in April, leading to a more decrease in supply. The total Bitcoin issuance is capped at $21 million, whereas over $19 million are already in circulation. It is to expect that the cost to produce Bitcoin will increase post-halving, affecting its price.

As far as Institutional involvement and Asset Management Growth is concerned, there is a significant increase in assets under management that reaches over 2.1 billion. The market is experiencing the maximum portion of inflow from new funds.

Post SEC Approval Revised BTC Price Target

While suggesting a revised price target for Bitcoin, Ms. Wood explained how the Bitcoin ETFs approval has changed the dynamics. ETFs approval is a huge milestone in the cryptocurrencies market. There ahs been prominent growth in the market despite few major financial institutions such as Bank Of America, Morgan Stanley, and Merryl Lynch not accepting Bitcoin.

The point of understanding here is clients have control over Bitcoin rather than any entity. The decentralization leaves decision making in clients’ hands. No centralized authority can take decisions related to ETFs. The SEC involvement also plays an important part in anticipation of high Bitcoin prices. Nonetheless, it is the best time to invest in Bitcoin rather than regretting it later.