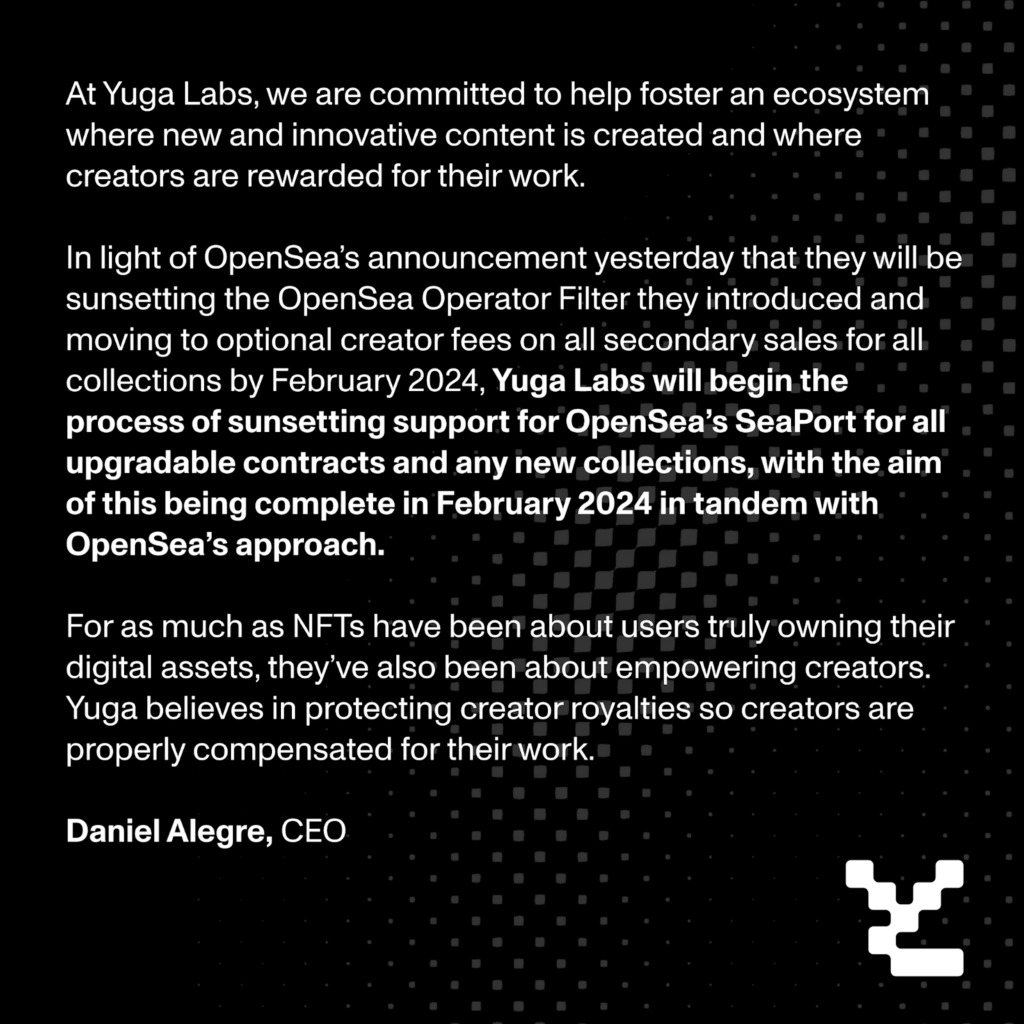

Yuga Labs recently announced it will be withdrawing its “all upgradable contracts and any new collections” from OpenSea. However, this does not encompass all NFTs within the YugaLabs ecosystem, says YuAyato, co-founder of BAYC Japan. “I think we will pre-arrange not to withdraw from OpenSea in the end.”

Bored Ape Yacht Club (BAYC) founder Yuga Labs might be considering transferring to an upgradeable contract. Upgradable contract NFTs include tokens like Otherdeed, KODA, HVMTL, and WreckLeague, all of which are the same contract for their blockchain operations.

YugaLabs’ Strategy to Control Royalties

After OpenSea’s statement, YuAyato explains that the company may consider the same strategy it used during its tussle with Blur:

“YugaLabs took the lead in the industry by switching to a contract that can be updated to prevent Blur, and as a result, depending on Opensea’s policy, it was possible to block Opensea as well, like this time,” he said.

To explain these simple words, YugaLabs switched to a type of contract that can be changed or updated. This change was meant to stop Blur from policing royalties. But here’s the interesting part: depending on the policies set by Opensea, YugaLabs could also prevent Opensea from doing certain things, just like what happened recently.

In short, YugaLabs gained some control and flexibility by switching their contract. This allows them to influence Blur and Opensea, depending on the situation.

Yuga Labs Switch to Blur

When Yuga first announced its contract policy, the relationship between them and Blur was openly hostile until January 2023. In fact, the creator company blacklisted the marketplace during its Sewer Pass Mint.

Yuga Labs later unblocked Blur after the marketplace changed its policy of protecting onchain royalties. This shift enabled YugaLabs to collect 5% royalties from new NFTs, such as HVMTL, marking a significant development in their relationship.

This is to note that the Existing NFTs issued before the introduction of Blur do not generate royalties.

In an effort to make the upgradeable contracts successful, YuAyato explains that there was a campaign encouraging people to switch their Otherdeed NFTs to the new contract. The holders could participate in a special collaboration between “Otherside” and GUCCI. However, only 46% of users have made the switch so far.

How are other NFT projects adjusting for royalties?

For onchain royalties, different projects have varying support levels; for instance, RTFKT supports it for “Animus Egg,” DigiDaigaku for NFTs after “Villains,” and Manifold fully backs onchain royalties with “EIP2981” compliance.

However, Ayato explains that Azuki had a problem doing this for their “Elementals” project. It came with a big risk because it could make the older NFTs less valuable.

OpenSea’s decision to remove its Royalty Enforcement Tool affects the collection of royalties within the OpenSea marketplace but does not directly impact onchain royalties, which are managed by the NFT’s underlying smart contract. Still, it remains a concern for Yuga regarding creator royalties.

Yuga’s long-term strategy for onchain royalties

Compared to Azuki, Yuga wants to separate the BAYC collection by categorizing it into “game-use” and “metaverse use”.

Although OpenSea’s decision to remove its Royalty Enforcement Tool affects the collection of royalties, it does not directly impact onchain royalties, which are managed by the NFT’s underlying smart contract.

Nonetheless, BAYC creators are considering moving to a new contract. But this will involve community decisions.

“Contract moving is a big event that tests the value of the relationship between the holder community and management, so it will be a moment when the results of community development so far will be questioned,” Ayato said.

Onchain royalties and contract renewability are becoming common issues across all NFT projects issued in 2022. This implies that more projects are recognizing the importance of properly addressing these aspects to ensure the fair compensation of creators and the adaptability of their NFT collections.

In summary, the future of onchain royalties for NFT collections is likely to see increased attention and standardization as projects grapple with contract migrations and aim to meet the expectations of their communities. How well these issues are addressed will serve as a crucial indicator of a project’s potential for success in the evolving NFT landscape.